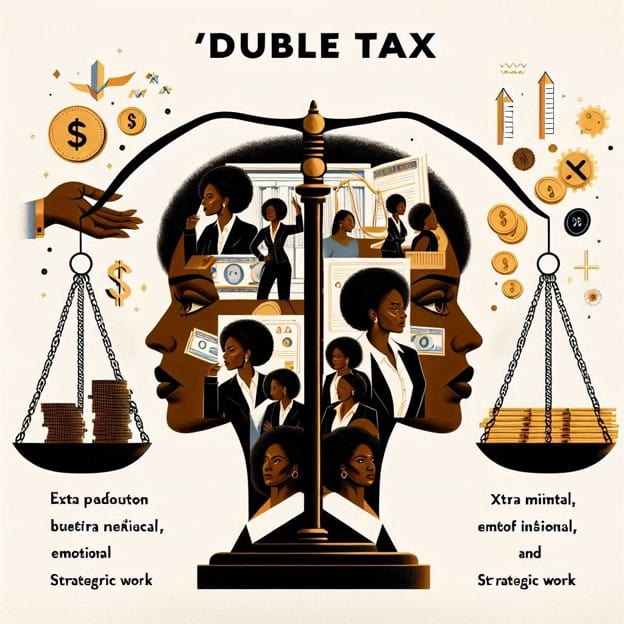

In professional settings, the concept of “invisible labor” refers to work that goes unrecognized, uncompensated, and often unacknowledged. For Black women leaders, this invisible labor takes on an additional dimension that I call the “double tax” – the extra mental, emotional, and strategic work required to navigate both racial and gender biases simultaneously while maintaining professional effectiveness.

This double tax isn’t just a theoretical concept. It represents real energy expenditure, time consumption, and cognitive load that impacts everything from daily decision-making to long-term career trajectories. Understanding, quantifying, and developing strategies to manage this tax is essential for Black women leaders seeking to thrive while preserving their well-being and authenticity.

Defining the Double Tax: Where Race and Gender Intersect

The double tax emerges at the intersection of racial and gender biases, creating what researchers call a “double bind” – a situation where Black women must navigate two sets of stereotypes and expectations simultaneously. Dr. Ella Bell Smith of Dartmouth’s Tuck School of Business explains this as “facing the compounded effects of both racism and sexism, neither of which can be separated from the other.”

This tax manifests in numerous ways that require additional labor:

1. Representation Labor

Black women leaders often find themselves serving as the “representative” of their entire demographic group, with their individual performance viewed as reflecting on all Black women. This creates intense pressure to be exceptional at all times while navigating the “quota mentality” – the unspoken but widely practiced concept that there can only be a limited number of Black women in leadership positions.

As I discuss in “Rise & Thrive: The Black Woman’s Blueprint for Leadership Excellence,” even well-intentioned organizations often unconsciously operate with the belief that one or two Black women in leadership is sufficient, while three or more represents a threatening shift in power dynamics. This creates a situation where individual Black women leaders must carefully consider how their advocacy for other Black women might be perceived, as it could jeopardize their own standing.

2. Code-Switching Labor

Research from the Center for Talent Innovation reveals that 41% of Black professionals feel they need to compromise their authentic selves to conform to conventional corporate standards. For Black women leaders, this often means monitoring and modulating speech, appearance, emotional expression, and communication style to avoid triggering racial and gender stereotypes.

This continuous self-monitoring depletes cognitive resources that could otherwise be directed toward strategic thinking and leadership tasks.

3. Emotional Management Labor

Black women leaders must perform extraordinary emotional management, often hiding genuine reactions to microaggressions or biased treatment to avoid being labeled as “angry,” “difficult,” or “not a team player.” This labor includes:

- Processing negative emotions privately rather than expressing them professionally

- Calculating the risks of addressing problematic behavior versus letting it pass

- Creating psychological distance from hurtful interactions while maintaining professional relationships

- Managing others’ discomfort around discussions of race and gender

4. Extra Preparation Labor

To counter the “prove it again” bias documented by researchers, where Black women must repeatedly demonstrate their competence despite established credentials, many find themselves overpreparing for every interaction. This includes:

- Anticipating and preparing for potential challenges to authority or expertise

- Gathering extensive data to support positions that others might advance with minimal evidence

- Developing multiple approaches to the same situation to adapt to possible resistance

- Rehearsing and refining communication for potentially challenging interactions

5. Strategic Navigation Labor

My personal experience as an HR executive illuminates this reality. After achieving compensation parity with my male colleagues – something that should have been celebrated as progress – I encountered a subtle but unmistakable backlash. When male leaders discovered my salary was comparable to theirs, microaggressions followed. I found myself assigned administrative tasks like ordering food for meetings – responsibilities none of my male counterparts at the same level were expected to perform. Meanwhile, resources were pulled from my department while my strategic responsibilities increased.

Addressing these shifts required careful strategic navigation – documenting the changes, strategically redirecting inappropriate tasks, building coalition support, and maintaining visibility for my strategic contributions – all representing additional labor not required of my peers.

Quantifying the Impact: The Real Cost of the Double Tax

The impact of this double tax extends beyond just “feeling tired.” It has quantifiable effects on time, energy, career progression, and well-being.

Time Impact

A 2021 study by McKinsey and LeanIn.org found that Black women spend an average of 17% more time than white men on “office housework” – administrative tasks that don’t contribute to advancement. When combined with the additional time spent on the various forms of labor detailed above, Black women leaders may be spending 25-30% of their work time on activities that don’t advance their careers or create organizational value.

Energy Depletion

Research on psychological resources shows that the continuous emotional regulation required by the double tax depletes willpower and decision-making capacity. Dr. Susan David’s work on emotional agility suggests that suppressing authentic emotional responses requires significant energy that could otherwise be directed toward creative and strategic work.

Health Consequences

The chronic stress associated with navigating the double tax has measurable health impacts. Research published in the Journal of Vocational Behavior found that the intersectional stress experienced by Black women professionals correlates with higher levels of anxiety, depression, and physical health symptoms compared to other demographic groups.

Career Advancement Impact

The concrete ceiling effect is real and measurable. Despite being highly educated and ambitious, Black women hold just 4.7% of management positions and only 1.6% of VP roles in Fortune 500 companies, despite making up approximately 7.4% of the U.S. population. This disparity reflects not just external biases but also the cumulative impact of the double tax on career progression.

Case Study: Quantifying Maya’s Double Tax

Consider Maya, a marketing director at a global consumer products company. Through careful tracking, Maya estimated that she spent approximately 12 hours per week on activities directly related to the double tax:

- 3 hours on extra preparation for meetings where she anticipated her expertise would be questioned

- 2.5 hours managing inappropriate administrative tasks assigned despite her leadership role

- 2 hours on emotional processing after microaggressions or biased interactions

- 2.5 hours building and maintaining relationships with stakeholders who might question her authority

- 2 hours documenting her contributions and creating visibility for her work

This represented nearly 30% of her work week – time that her peers could direct toward strategic thinking, innovation, or skill development. Over a year, this amounted to approximately 600 hours of additional labor – the equivalent of 15 standard work weeks.

By tracking this impact, Maya was able to develop targeted strategies to reclaim some of this time while building awareness among allies about the double tax she faced.

Managing the Double Tax: Strategic Approaches

While eliminating the double tax requires systemic change, there are strategic approaches that individual Black women leaders can employ to manage its impact:

1. Strategic Energy Management

Rather than trying to eliminate the double tax entirely (which is often impossible in current organizational contexts), focus on managing your energy strategically:

Energy Audit: Track your activities for two weeks, noting which tasks energize you versus those that deplete you. Identify which depleting activities are related to the double tax.

Energy Blocking: Schedule your day to alternate between high-energy and low-energy tasks, placing the most cognitively demanding work during your peak mental performance times.

Energy Renewal: Build intentional recovery practices into your daily and weekly schedule – even short periods of renewal can significantly improve cognitive performance and emotional resilience.

Action step: Create a personalized energy management plan that includes at least three daily micro-renewal practices (2-5 minutes each) and one weekly deeper renewal practice (1-2 hours).

2. Strategic Task Management

Reclaim time by addressing the inappropriate distribution of administrative work:

Role Clarification Document: Create a clear document outlining your strategic responsibilities and how they align with organizational goals. Reference this when non-strategic tasks are assigned.

Strategic Delegation: Develop standard responses for redirecting administrative tasks, such as: “I’d be happy to identify the right resource for that task, but my focus needs to remain on [strategic priority] to ensure we meet our quarterly objectives.”

Comparative Documentation: Discreetly document task assignments across leaders at your level to identify patterns that can be addressed with senior leadership if necessary.

Action step: Draft and practice three “strategic redirection” responses for commonly assigned non-strategic tasks.

3. Sponsorship and Allyship Cultivation

While the saying that “even with a white male sponsor, he will never advocate for you enough to be his neighbor” reflects a common reality, strategic approaches to sponsorship can still yield benefits:

Sponsor Portfolio: Rather than relying on a single sponsor, develop multiple advocacy relationships across different departments, levels, and demographic backgrounds.

Clear Advocacy Requests: Make specific, actionable requests of sponsors rather than general requests for support.

Ally Education: Educate potential allies about the concrete ceiling and specific ways they can support your leadership visibility.

Action step: Identify three potential sponsors and develop specific, strategic requests for each that would advance your leadership visibility.

4. Strategic Documentation

Create systems to document both the double tax and your strategic contributions:

Value Documentation: Maintain a weekly log of your strategic contributions, with particular attention to quantifiable impacts on business outcomes.

Pattern Documentation: Track instances of the double tax, noting patterns that might be addressed systemically.

Visibility Creation: Develop a regular communication that highlights your team’s strategic contributions and connects them explicitly to organizational priorities.

Action step: Create a simple tracking system for both your strategic contributions and instances of the double tax.

5. Community and Support Network

Build connections with other Black women leaders who understand the double tax without explanation:

Peer Coaching Circles: Join or form a small group of Black women leaders who meet regularly to share strategies and support.

Professional Associations: Engage with organizations like the Executive Leadership Council or Black Women’s Network that provide both development and community.

Executive Coaching: Consider working with a coach who understands the unique challenges of the double tax and can provide tailored strategies.

Action step: Identify one community resource you can engage with in the next 30 days.

The Entrepreneurship Alternative

It’s no coincidence that Black women represent the fastest-growing demographic of entrepreneurs in America. According to the 2019 State of Women-Owned Businesses Report, businesses owned by Black women grew by 50% between 2014 and 2019—a rate more than double that of women-owned businesses overall.

For many Black women leaders, entrepreneurship becomes a compelling alternative when the double tax becomes unsustainable. In entrepreneurial settings, many (though certainly not all) aspects of the double tax can be mitigated by:

- Greater control over organizational culture and norms

- Ability to select clients and partners who recognize and value your expertise

- Freedom to create authentic leadership approaches without code-switching

- Opportunity to build diverse teams from the ground up

As I often tell my coaching clients, “If they won’t let you lead at their table, build your own table—and make it magnificent.”

The Organizational Imperative: Reducing the Double Tax

While individual strategies are essential, lasting change requires organizational transformation. In “Mastering a High-Value Company Culture,” I outline how organizations must address these issues systemically:

- Implement task equity audits to identify and correct patterns of administrative task assignment based on gender or race

- Create accountability for microaggressions through clear reporting channels and consequences

- Establish sponsorship effectiveness metrics that track sponsorship outcomes across demographic groups

- Train leaders on the double tax and specific ways they can reduce its impact on team members

- Review promotion and advancement criteria to ensure they don’t penalize time spent on invisible labor

Organizations that fail to address the double tax don’t just harm individual careers—they undermine their own effectiveness by misallocating valuable leadership talent and eventually losing Black women leaders to entrepreneurship or more inclusive competitors.

The Kamala Harris Effect: Seeing the Double Tax in Action

The heightened scrutiny and criticism faced by Vice President Kamala Harris provides a high-profile example of the double tax in action. Despite her exceptional credentials—former District Attorney, Attorney General of California, U.S. Senator, and now Vice President—Harris faces attacks on her competence that far exceed normal political critique.

This “Kamala Harris effect,” as I term it, mirrors what happens to Black women leaders across sectors when they achieve positions traditionally reserved for others. The questioning of qualifications, dismissal of expertise, and heightened scrutiny of communication style exemplify the tax Black women leaders pay regardless of their credentials or accomplishments.

As Roland Martin explores in “The Browning of America,” demographic shifts are creating anxiety about traditional power structures. This broader societal tension often manifests in individual interactions, where even well-intentioned leaders may unconsciously resist the advancement of Black women into positions of equal power.

From Double Tax to Double Advantage

While the double tax is real and significant, the skills developed in navigating it can also create unique leadership advantages. The ability to:

- Read subtle social cues and power dynamics

- Adapt communication for different audiences

- Navigate complex organizational politics

- Build authentic connections across difference

- Maintain resilience through challenging circumstances

These capabilities, honed through necessity, represent valuable leadership assets in increasingly diverse and complex organizational environments. The key is recognizing these strengths while working to reduce the tax that developing them has required.

Moving Forward: Strategic Clarity

Understanding and naming the double tax isn’t about fostering hopelessness—it’s about strategic clarity that preserves agency. As I often tell my coaching clients, “When you can name it, you can manage it.”

The double tax is real, but it need not define your leadership journey. By quantifying its impact, developing strategic responses, and choosing contexts where your leadership can thrive, you can advance your career while maintaining your well-being and authenticity.

Questions for Reflection

- Which aspects of the double tax most impact your leadership effectiveness and well-being? What patterns have you noticed in how it manifests in your work environment?

- What strategies have you found most effective in managing the double tax? Which approaches from this article seem most applicable to your situation?

- How might you educate allies and sponsors about the double tax in ways that generate support rather than defensiveness?

- If you’re considering entrepreneurship, what aspects of the double tax might still apply in that context, and how might you prepare to address them?

Working with Che’ Blackmon Consulting

At Che’ Blackmon Consulting, we specialize in helping both organizations and individuals navigate the complex challenges at the intersection of leadership, race, and gender. Our approach combines evidence-based strategies with practical implementation tools designed to create lasting change.

For Black women leaders, we offer executive coaching programs specifically designed to help you manage the double tax while advancing your leadership impact and preserving your well-being.

For organizations, we provide comprehensive cultural transformation services that address the systemic issues creating unequal labor burdens for diverse leaders.

To learn more about working with Che’ Blackmon Consulting to unlock potential, empower leadership, and transform your organization, contact us at admin@cheblackmon.com or 888.369.7243, or visit https://cheblackmon.com.

Remember: While the double tax represents a real burden, recognizing and naming it is the first step toward developing strategies that allow your leadership to thrive despite these challenges. Your leadership journey may include additional labor, but with strategic approaches, it need not define your experience or limit your impact.

#BlackWomenLeaders #DoubleBindEffect #LeadershipEquity #WorkplaceDiversity #InvisibleLabor #CareerStrategy #DEI #ExecutiveLeadership

2 responses to “The Double Tax: Quantifying and Managing the Extra Labor of Being a Black Woman Leader”

https://shorturl.fm/uyMvT

https://shorturl.fm/hQjgP